news, people, new vacuum pumps, mergers and acquisition

new large aperture motorized rotary stages for vacuum applications

new large aperture motorized rotary stages for vacuum applications

IntelLiDrives released a new large aperture motorized stages RTHM-191 manufactred to operate in 10-6 Torr vacuum, with all mechanical parts lubricated with high vacuum compatible grease. Aluminum parts are not anodized. Stages are cleaned in vacuum chamber and packed before dispatch. more |

Agilent Technologies Expands Vacuum Products Portfolio with Acquisition of Pump Maker P.V.R.

Agilent Technologies Expands Vacuum Products Portfolio with Acquisition of Pump Maker P.V.R.

SANTA CLARA, Calif., Dec. 21, 2011 Agilent Technologies Inc. (NYSE: A) today announced it has acquired P.V.R. s.r.l., a long-established vacuum pump manufacturer based in Valmadrera, Italy. The addition of P.V.R., a privately held company, expands Agilent's vacuum products portfolio for industrial applications. more |

Graham Corporation awarded three new orders with a combined value of $4.3 million

Graham Corporation awarded three new orders with a combined value of $4.3 million

Nov. 3, 2011 Graham Corporation today announced that it has been awarded three new orders with a combined value of $4.3 million. An order for an ethylene production facility in Asia, which is expanding production capacity, requires two of Graham's custom-engineered surface condensers. The additional two orders are for U.S. installations. A Graham vacuum ejector system will be installed in an oil refinery that is being revamped to expand its capacity and provide the capability of processing Bakken crude oil from North Dakota shale formations. Finally, Graham will supply a steam surface condenser for a 40 MW biomass power plant. This is the seventh biomass power project order Graham has secured over the last year. more |

Graham Corp. appoints Robert A. Platt, PE, as Vice President of Sales

Graham Corp. appoints Robert A. Platt, PE, as Vice President of Sales

Nov. 3, 2011 Graham announced that Robert A. Platt, PE, was appointed Vice President of Sales, effective October 27, 2011. Mr. Platt brings to Graham significant industry experience in sales and general management. Prior to joining Graham, Mr. Platt was most recently President of API Basco, a heat transfer company. Previously, he has held leadership positions at Maag Systems, Carver Pump Company, Ingersoll Dresser Pumps and Bornemann Pumps. A registered professional engineer, he earned his undergraduate and master’s degrees in mechanical engineering from the Stevens Institute of Technology. more |

Gardner Denver Announces Agreement to Acquire Robuschi

Gardner Denver Announces Agreement to Acquire Robuschi

Oct. 11, 2011 Gardner Denver, Inc. announced today that it has entered into a share purchase agreement with the holders of 100 percent of the outstanding shares of Robuschi S.p.A. ("Robuschi"), a market leading European manufacturer of blowers and pumps, for a purchase price of approximately EUR 152 million ($207 million at current exchange rates). Robuschi is headquartered in Parma, Italy, and has annual revenues of approximately EUR 70 million ($95 million). Its shares are currently held by an investor group led by Milan, Italy based Aksia Group. more |

Agilent Technologies Publishes New Vacuum Products Catalog

Agilent Technologies Publishes New Vacuum Products Catalog

Aug. 10, 2011 Agilent Technologies Inc. today announced publication of the latest edition of its Vacuum Products Catalog. This 520-page compendium features 3,850 products and accessories, plus application and technical notes. This is the most comprehensive catalog in our 50-plus-year history - said Giampaolo Levi, vice president and general manager of Agilent's Vacuum Products Division. more and download |

Second quarter 2011: Gardner Denver Delivers Record Results

Second quarter 2011: Gardner Denver Delivers Record Results

WAYNE, PA, Jul 21, 2011 Gardner Denver, Inc. (NYSE: GDI) today announced second quarter 2011 results that established quarterly records for orders, revenues, operating income and DEPS. In addition, backlog at June 30, 2011 was $681.7 million, an all-time high. Revenues and operating income were $610.7 million and $99.2 million, respectively. Operating income improved 75% compared to the three-month period of the prior year, increasing to $99.2 million from $56.6 million in 2010. Operating income as a percentage of revenues was 16.2% in the second quarter of 2011, up 360 basis points compared to 12.6% in last year's second quarter. The increase in operating income was largely driven by incremental profitability on the revenue growth, favorable product mix and the benefits of operational improvements previously implemented. For the second quarter of 2011, net income and DEPS attributable to Gardner Denver were $67.1 million and $1.27, respectively. The three-month period ended June 30, 2011 included expenses for profit improvement initiatives and other items totaling $5.2 million, or $0.08 DEPS. download the complete report (pdf) |

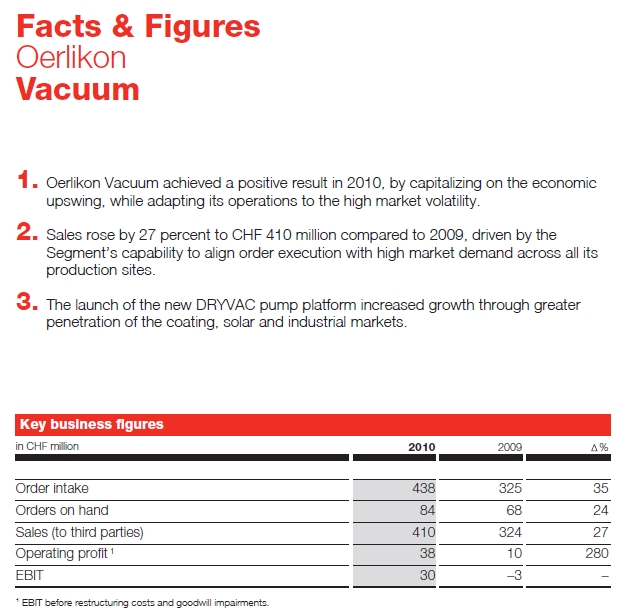

Oerlikon - Facts and figures for an extraordinary business year 2010

Oerlikon - Facts and figures for an extraordinary business year 2010

Pfäffikon SZ, March 23, 2011 - Media and analyst conference for the 2010 annual results Oerlikon Vacuum can look back on an extraordinary business year. Order intake rose strongly to CHF 438 million in 2010, a plus of 35 percent. Sales increased by 27 percent to CHF 410 million. Orders on hand amounted to CHF 84 million at year-end (previous year: CHF 68 million). The operating profit reached CHF 38 million in 2010 from CHF 10 million in 2009. The Segment returned to profitability, and EBIT improved to CHF 30 million in 2010 from CHF –3 million in 2009 due to the benefits of the Segment's cost management efforts that offset the unfavorable impact of foreign exchange rates. more |

Graham Corporation Receives Orders totaling approximately $6.5 million

Graham Corporation Receives Orders totaling approximately $6.5 million

BATAVIA, NY, March 21, 2011 – Graham Corporation (NYSE Amex: GHM) a designer and manufacturer of critical equipment for the oil refining, petrochemical and power industries, including the supply of components and raw materials to nuclear power plants, today announced that it has been awarded five orders totaling approximately $6.5 million. more |

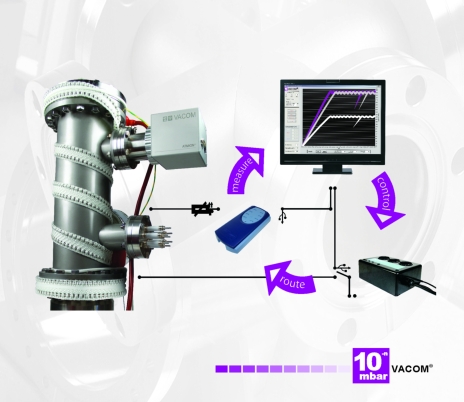

Controlled Bake-out in Vacuum (Heating Solution)

Controlled Bake-out in Vacuum (Heating Solution)

VACOM offers reliable, application-proven and innovative vacuum technology for your application from atmosphere to ultra-high vacuum. Customised solutions to measure and regulate your vacuum process are our strength: New in Vacom product range: Controlled Bake-out in Vacuum (Heating Solution) - a package consisting of software and hardware to control heating devices on your system. more |

new large aperture motorized rotary stages for vacuum applications

IntelLiDrives released a new large aperture motorized stages RTHM-191 manufactured to operate in 10-6 Torr vacuum, with all mechanical parts lubricated with high vacuum compatible grease. Aluminum parts are not anodized.

Stages are cleaned in vacuum chamber and packed before dispatch. Optionally, stages can be fitted with vacuum compatible DC motor on request.

The RTHM-191 compact rotation stages are designed to rotate optical components and small tooling in confined spaces, such as laser cavities, disk texturing machines or manufacturing areas for fiber optical components and semiconductor devices.

Proprietary bearing design provides smooth rotation with minimal wobble. A precision ground worm gear produces consistent driving torque to the rotor and eliminates variations in the motor current.

RTHM-191 stages feature an angular resolution up to 0.1 arc-sec. The stages are equipped with a reference home sensor and can run in continuous rotation mode and mounted horizontally or vertically. RTHM-191 manufactured with large center aperture 90 mm.

IntelLiDrives, Inc. - www.intellidrives.com - Linear Motion in its Simplest Form

Greg Kane, e-mail: admin@intellidrives.com, Tel. +1 215.728.6804

Agilent Technologies Expands Vacuum Products Portfolio with Acquisition of Pump Maker P.V.R.

Agilent Technologies Inc. (NYSE: A) today announced it has acquired P.V.R. s.r.l., a long-established vacuum pump manufacturer based in Valmadrera, Italy. The addition of P.V.R., a privately held company, expands Agilent's vacuum products portfolio for industrial applications. Financial details of the transaction were not disclosed.

P.V.R. began designing and manufacturing vacuum pumps in the 1960s. Its current portfolio includes rotary vane vacuum pumps for the industrial market, as well as oil-free micro pumps, rotary lobe vacuum pumps, dry rotary claw vacuum pumps, central vacuum systems, and vacuum accessories for the food, paper, chemical and other industries.

Agilent's Vacuum Products Division has had an original equipment manufacturer relationship with P.V.R. since 2008. Agilent gained its vacuum division as part of the Varian Inc. acquisition in 2010.

"P.V.R. has been a trusted partner for years," said Giampaolo Levi, Agilent's vice president and general manager, Vacuum Products Division. "Joining together as one company will only accelerate our innovations and increase our ability to serve customers faster and better with a broader range of solutions. This acquisition is a very good example of the whole being greater than the sum of its parts."

P.V.R.'s products complement Agilent's existing vacuum portfolio, which includes high vacuum pumps, dry and wet primary pumps, and vacuum instrumentation. The acquisition also brings Agilent a significant vacuum customer base in the growth markets of Asia.

"By joining Agilent, our business will grow to the next level," said Stefano Severgnini, former managing director of P.V.R. "We will benefit from Agilent's global distribution channels and brand, which will help our business expand to new regions and more customers. And we value Agilent's ongoing investments in R&D, ensuring that its vacuum technology leads the market."

P.V.R.'s 38 employees have now joined a wholly owned subsidiary of Agilent in Italy.

About Agilent Technologies

Agilent Technologies Inc. (NYSE: A) is the world's premier measurement company and a technology leader in chemical analysis, life sciences, electronics and communications. The company's 18,700 employees serve customers in more than 100 countries. Agilent had net revenues of $6.6 billion in fiscal 2011.

Information about Agilent is available at www.agilent.com.

Graham Corporation awarded three new orders with a combined value of $4.3 million

Nov. 3, 2011

Graham Corporation (NYSE Amex: GHM), a global designer and manufacturer of critical equipment for the oil refining, petrochemical and power industries, including the supply of components and raw materials to nuclear power plants, today announced that it has been awarded three new orders with a combined value of $4.3 million. All three orders are expected to ship in the fiscal year ending March 31, 2013 (“fiscal 2013”).

An order for an ethylene production facility in Asia, which is expanding production capacity, requires two of Graham’s custom-engineered surface condensers. These condensers are currently planned for shipment in the third quarter of fiscal 2013, which ends December 2012.

The additional two orders are for U.S. installations. A Graham vacuum ejector system will be installed in an oil refinery that is being revamped to expand its capacity and provide the capability of processing Bakken crude oil from North Dakota shale formations. It is expected to be shipped in the first quarter of fiscal 2013, which ends June 2012. Finally, Graham will supply a steam surface condenser in the second quarter of fiscal 2013, which ends September 2012, for a 40 MW biomass power plant. This is the seventh biomass power project order Graham has secured over the last year.

James R. Lines, Graham’s President and Chief Executive Officer, commented, “Our global pipeline of opportunities continues to improve in quality, with order development and margins improving over the last nine months compared with the year-ago period. We believe that these wins are among the signals which indicate to us that our markets, as a whole, are improving. Petrochemical markets are expanding in Asia and, in the U.S., there is renewed activity in the refining markets along with continued advancement of alternative energy projects. Moreover, we have identified significant opportunities at existing nuclear power facilities, as well as new build nuclear power facilities that are currently under construction.”

www.graham-mfg.com

Gardner Denver Announces Agreement to Acquire Robuschi

WAYNE, PA, Oct 11, 2011

Gardner Denver, Inc. (NYSE: GDI) announced today that it has entered into a share purchase agreement with the holders of 100 percent of the outstanding shares of Robuschi S.p.A. ("Robuschi"), a market leading European manufacturer of blowers and pumps, for a purchase price of approximately EUR 152 million ($207 million at current exchange rates). Robuschi is headquartered in Parma, Italy, and has annual revenues of approximately EUR 70 million ($95 million). Its shares are currently held by an investor group led by Milan, Italy based Aksia Group.

Robuschi is a leading European producer of blowers, pumps and associated packages. These products are used in a wide variety of end markets including wastewater, mining, and power generation, as well as general industrial applications. With facilities in Noceto, Italy; Sao Paulo, Brazil; and Shanghai, China, in addition to its main production facility in Parma, Robuschi serves over 3,000 customers and has an installed base in excess of 200,000 units.

"Robuschi is an outstanding strategic addition to the Gardner Denver portfolio and an excellent fit with our Industrial Products Group," stated Barry L. Pennypacker, President and Chief Executive Officer of Gardner Denver. "Robuschi's advanced manufacturing capabilities are expected to enable significant cost synergies as we continue to optimize our European manufacturing footprint supported by the principles of the Gardner Denver Way. I would like to welcome the talented employees of Robuschi to the Gardner Denver family and I look forward to developing the strong Robuschi brand name globally."

The transaction is subject to customary closing conditions, including the receipt of applicable regulatory approvals, and is expected to close in the fourth quarter of 2011.

Cautionary Statement Regarding Forward-Looking Statements This press release contains forward-looking statements that involve risks and uncertainties. Forward-looking statements generally can be identified by the use of forward-looking terminology such as "could," "should," "anticipate," "expect," "believe," "will," "project," "lead," or the negative thereof or variations thereon or similar terminology. The actual future performance of the Company could differ materially from such statements. Factors that could cause or contribute to such differences include, but are not limited to: changing economic conditions; pricing of the Company's products and other competitive market pressures; the costs and availability of raw materials; fluctuations in foreign currency exchange rates and energy prices; risks associated with the Company's current and future litigation; and the other risks detailed from time to time in the Company's SEC filings, including but not limited to, its Annual Report on Form 10-K for the fiscal year ending December 31, 2010, and its subsequent quarterly reports on Form 10-Q for the 2011 fiscal year. You are cautioned not to place undue reliance on these forward-looking statements, which speak only as of the date of this press release. The Company does not undertake, and hereby disclaims, any duty to update these forward-looking statements, although its situation and circumstances may change in the future.

Gardner Denver, Inc., with 2010 revenues of approximately $1.9 billion, is a leading worldwide manufacturer of highly engineered products, including compressors, liquid ring pumps and blowers for various industrial, medical, environmental, transportation and process applications, pumps used in the petroleum and industrial market segments and other fluid transfer equipment, such as loading arms and dry break couplers, serving chemical, petroleum and food industries. Gardner Denver's news releases are available by visiting the Investors section on the Company's website (www.GardnerDenver.com).

Contact:

Michael M. Larsen, Vice President and CFO, Tel. +1 (610) 249-2002

Agilent Technologies Publishes New Vacuum Products Catalog

Aug. 10, 2011

Agilent Technologies Inc. (NYSE: A) today announced publication of the latest edition of its Vacuum Products Catalog. This 520-page compendium features 3,850 products and accessories, plus application and technical notes.

Agilent's Vacuum Products Division, formerly part of Varian, serves customers in research and development, particle accelerators, mass spectrometry and other scientific instrumentation, nanotechnology, and industrial vacuum processes. Products include rough vacuum pumps (rotary vane, high capacity rotary vane and dry scroll pumps), high vacuum pumps (diffusion and turbomolecular), ultra-high vacuum pumps (ion and titanium sublimation combination), all-in-one pumping systems, vacuum measurement and control devices, and leak detectors.

This is the most comprehensive catalog in our 50-plus-year history - said Giampaolo Levi, vice president and general manager of Agilent's Vacuum Products Division. "We’re sure customers in research and industry will find it to be an indispensible tool for tailoring vacuum systems to their precise needs"

The free catalog is available in print or on CD, and can also be downloaded from the Agilent website.

To order in North America, call 800-882-7426. In Europe, call 00 800 234 234 00.

Or download at www.agilent.com/chem/vacuumcatalog.

About Agilent Technologies

Agilent Technologies Inc. is the world’s premier measurement company and a technology leader in chemical analysis, life sciences, electronics and communications. The compan's 18,500 employees serve customers in more than 100 countries. Agilent had net revenues of $5.4 billion in fiscal 2010. Information about Agilent is available at www.agilent.com

Second quarter 2011: Gardner Denver Delivers Record Results

WAYNE, PA, Jul 21, 2011

-- Strong second quarter 2011 orders of $637.0 million and revenues of $610.7 million, up 27% and 36%, respectively, over the same period of 2010.

-- Record Diluted Earnings per Share ("DEPS") were $1.27 for the second quarter, an increase of 79% compared to $0.71 in the second quarter of 2010.

-- Updated guidance: estimated third quarter 2011 DEPS of $1.27 to $1.32 and total year DEPS of $5.05 to $5.15, including profit improvement costs and other items totaling $0.03 per diluted share for the third quarter and $0.15 per diluted share for the full year.

Gardner Denver, Inc. (NYSE: GDI) today announced second quarter 2011 results that established quarterly records for orders, revenues, operating income and DEPS. In addition, backlog at June 30, 2011 was $681.7 million, an all-time high. Revenues and operating income were $610.7 million and $99.2 million, respectively. Operating income improved 75% compared to the three-month period of the prior year, increasing to $99.2 million from $56.6 million in 2010. Operating income as a percentage of revenues was 16.2% in the second quarter of 2011, up 360 basis points compared to 12.6% in last year's second quarter. The increase in operating income was largely driven by incremental profitability on the revenue growth, favorable product mix and the benefits of operational improvements previously implemented. For the second quarter of 2011, net income and DEPS attributable to Gardner Denver were $67.1 million and $1.27, respectively. The three-month period ended June 30, 2011 included expenses for profit improvement initiatives and other items totaling $5.2 million, or $0.08 DEPS.

CEO's Comments

"Gardner Denver had an outstanding second quarter with strong, broad based organic growth across our diverse portfolio of businesses and significant margin expansion," said Barry L. Pennypacker, Gardner Denver's President and Chief Executive Officer. "As evidenced by the record breaking orders, revenue and DEPS achieved in the second quarter, we continue to progress on our strategic priorities and improve operational execution supported by the Gardner Denver Way. Both of the Company's reportable segments delivered strong operational performance in the quarter, resulting in operating margins expanding by 360 basis points compared to the prior year. The Industrial Products Group (IPG) improved margins sequentially for the ninth consecutive quarter and continued to benefit from healthy organic growth in North America and Asia Pacific. The Engineered Products Group (EPG) benefited from broad strength across the portfolio and especially strong demand for petroleum pumps and related aftermarket parts and services."

Mr. Pennypacker continued, "Cash provided by operating activities was more than $66 million in the second quarter, a 63% improvement compared to the same period of 2010. In addition, we invested $13.0 million in capital expenditures in the second quarter of 2011, with a sustained focus on operational improvements and increased production output to meet customer demand. The Company expects capital expenditures to total approximately $50 to $55 million in 2011. Our focus on cash generation and disciplined capital allocation remains a top priority for 2011. The acquisition pipeline is strong, and we continue to selectively evaluate appropriate opportunities as they become available."

Outlook

"Our backlog for EPG remains at record levels, yielding a very positive outlook for the remainder of 2011. Demand for well servicing pumps and aftermarket fluid ends continues to grow sharply as shale activity increases and we are investing in additional capacity to meet these growing needs. Further, the demand for engineered packages and OEM compressors remains strong," commented Mr. Pennypacker.

"For the remainder of 2011, we expect continued revenue growth in IPG as a result of healthy demand in our core end markets as well as strong growth in emerging markets such as China. We anticipate that global capacity utilization will remain steady in 2011, resulting in sustained levels of manufacturing spending and investment in customer plants. We remain optimistic that this steady growth will drive demand for IPG's compressors, blowers and vacuum products as well as opportunities for replacement parts and services."

Mr. Pennypacker stated, "Based on this outlook, our existing backlog and productivity improvement plans, we are projecting third quarter 2011 DEPS to be in a range of $1.27 to $1.32 and are raising our full-year 2011 DEPS range to $5.05 to $5.15. This projection includes profit improvement costs and other items totaling $0.03 per diluted share for the third quarter of 2011 and $0.15 per diluted share for the full-year 2011. Third quarter 2011 DEPS, as adjusted for the impact of profit improvement costs and other items ("Adjusted DEPS"), are expected to be in a range of $1.30 to $1.35. The midpoint of the Adjusted DEPS range for the third quarter of 2011 ($1.33) represents a 51% increase over the same period of 2010. Full-year 2011 Adjusted DEPS are expected to be in a range of $5.20 to $5.30. The midpoint of the updated Adjusted DEPS range for the full-year 2011 ($5.25) represents a 55% increase over 2010 results and a 13% increase from the full-year 2011 guidance issued in April. The effective tax rate assumed in the DEPS guidance for 2011 is unchanged at 28%."

Engineered Products Group (EPG)

EPG orders and revenues increased 43% and 56%, respectively, for the three months ended June 30, 2011, compared to the same period of 2010, reflecting sustained, strong demand for drilling and well servicing pumps and engineered packages. In the second quarter of 2011, favorable changes in foreign currency exchange rates increased orders and revenues for EPG by 5% and 6%, respectively. The ILMVAC acquisition, completed in the third quarter of 2010, increased both orders and revenues by 2%. Organically, EPG generated order and revenue growth of 36% and 48%, respectively, in the second quarter of 2011, compared to the prior year period.

Segment operating income(1), as reported under generally accepted accounting principles in the U.S. ("GAAP"), for EPG for the three months ended June 30, 2011 was $64.8 million and segment operating margin(1) was 22.9%, compared to $36.4 million and 20.1%, respectively, in the same period of 2010. Operating Income, as adjusted to exclude the net impact of expenses incurred for profit improvement initiatives and other items ("Adjusted Operating Income"), for EPG for the second quarter of 2011 was $65.9 million and segment Adjusted Operating Income as a percentage of revenues was 23.3%. Adjusted Operating Income for EPG in the second quarter of 2010 was $35.2 million, or 19.5% of revenues. The improvement in Adjusted Operating Income for this segment was primarily attributable to incremental profitability on revenue growth, favorable product mix and cost reductions. See the "Selected Financial Data Schedule" and the "Reconciliation of Operating Income and DEPS to Adjusted Operating Income and Adjusted DEPS" at the end of this press release.

Industrial Products Group (IPG)

Orders and revenues for IPG increased 15% and 22%, respectively, in the second quarter, compared to the same period of 2010, reflecting on-going improvement in demand for OEM products, compressors and aftermarket parts and services. In the second quarter of 2011, favorable changes in foreign currency exchange rates increased orders and revenues for the Industrial Products segment by 9%. Organically, IPG generated order and revenue growth of 6% and 13%, respectively, in the second quarter of 2011, compared to the prior year period.

Segment operating income(1) and segment operating margin(1), as reported under GAAP, for the Industrial Products segment for the three months ended June 30, 2011 were $34.3 million and 10.5%, respectively, compared to $20.2 million and 7.5% of revenues for the three months ended June 30, 2010. Adjusted Operating Income for IPG in the second quarter of 2011 was $38.5 million and Adjusted Operating Income as a percentage of revenues was 11.7%. By comparison, Adjusted Operating Income for IPG was $23.2 million, or 8.6% of revenues, in the three-month period of 2010. The improvement in Adjusted Operating Income for this segment was primarily attributable to incremental profit on revenue growth and cost reductions. See the "Selected Financial Data Schedule" and the "Reconciliation of Operating Income and DEPS to Adjusted Operating Income and Adjusted DEPS" at the end of this press release.

Gardner Denver Consolidated Results

Adjusted Operating income, which excludes the net impact of expenses incurred for profit improvement initiatives and other items ($5.2 million), for the three-month period ended June 30, 2011 was $104.4 million, compared to $58.4 million in the prior year period. Adjusted Operating Income as a percentage of revenues improved to 17.1% from 13.0% in the second quarter of 2010. Adjusted DEPS for the three-month period ended June 30, 2011, were $1.35, compared to $0.73 in the three-month period of 2010. Adjusted Operating Income, on a consolidated and segment basis, and Adjusted DEPS are both financial measures that are not in accordance with GAAP. See "Reconciliation of Operating Income and DEPS to Adjusted Operating Income and Adjusted DEPS" at the end of this press release. Gardner Denver believes the non-GAAP financial measures of Adjusted Operating Income and Adjusted DEPS provide important supplemental information to both management and investors regarding financial and business trends used in assessing its results of operations. Gardner Denver believes excluding the specified items from operating income and DEPS provides a more meaningful comparison to the corresponding reported periods and internal budgets and forecasts, assists investors in performing analysis that is consistent with financial models developed by investors and research analysts, provides management with a more relevant measurement of operating performance and is more useful in assessing management performance.

Forward-Looking Information

This press release contains forward-looking statements that involve risks and uncertainties. Forward-looking statements generally can be identified by the use of forward-looking terminology such as "could," "should," "anticipate," "expect," "believe," "will," "project," "lead," or the negative thereof or variations thereon or similar terminology. The actual future performance of the Company could differ materially from such statements. Factors that could cause or contribute to such differences include, but are not limited to: changing economic conditions; pricing of the Company's products and other competitive market pressures; the costs and availability of raw materials; fluctuations in foreign currency exchange rates and energy prices; risks associated with the Company's current and future litigation; and the other risks detailed from time to time in the Company's SEC filings, including but not limited to, its Annual Report on Form 10-K for the fiscal year ending December 31, 2010, and its subsequent quarterly reports on Form 10-Q for the 2011 fiscal year. You are cautioned not to place undue reliance on these forward-looking statements, which speak only as of the date of this press release. The Company does not undertake, and hereby disclaims, any duty to update these forward-looking statements, although its situation and circumstances may change in the future.

Comparisons of the financial results for the three and six-month periods ended June 30, 2011 and 2010 follow.

Gardner Denver will broadcast a conference call to discuss results for the second quarter of 2011 on Friday, July 22, 2011 at 9:30 a.m. Eastern Time through a live webcast. This free webcast will be available in listen-only mode and can be accessed, for up to ninety days following the call, through the Investor Center on the Gardner Denver website at www.GardnerDenver.com or through Thomson StreetEvents at www.earnings.com.

Corporate Profile

Gardner Denver, Inc., with 2010 revenues of approximately $1.9 billion, is a leading worldwide manufacturer of highly engineered products, including compressors, liquid ring pumps and blowers for various industrial, medical, environmental, transportation and process applications, pumps used in the petroleum and industrial market segments and other fluid transfer equipment, such as loading arms and dry break couplers, serving chemical, petroleum and food industries. Gardner Denver's news releases are available by visiting the Investors section on the Company's website www.GardnerDenver.com

download the report: 2011 Q2 Gardner-Denver financial results

Oerlikon - Facts and figures for an extraordinary business year 2010

|

Business development

Oerlikon Vacuum can look back on an extraordinary business year. Order intake rose strongly to CHF 438 million in 2010, a plus of 35 percent. Sales increased by 27 percent to CHF 410 million. Orders on hand amounted to CHF 84 million at year-end (previous year: CHF 68 million). The operating profit reached CHF 38 million in 2010 from CHF 10 million in 2009. The Segment returned to profitability, and EBIT improved to CHF 30 million in 2010 from CHF –3 million in 2009 due to the benefits of the Segment’s cost management efforts that offset the unfavorable impact of foreign exchange rates.

Business in the coating, solar and semiconductor industries grew significantly, with orders rising 75 percent compared to 2009. In the process industry, supply chain management issues impacted sales which rose 17 percent, allthough orders increased 33 percent year on year. Order intake in the analytical and R&D industry grew by 11 percent, with sales rising by 9 percent compared to 2009. The solution business showed the strongest demand, followed by components and services.

Order intake grew considerably in all regions. While Europe showed a slow, but stable, recovery, business in the US improved substantially, almost regaining pre-crisis levels. However, growth in Asia proved to be the major driver for the segment's strong operational recovery. The development of business in this region had an unexpected, positive impact on the segment's performance. In 2010, the segment continued with its program to reduce fixed costs sustainably and streamline operations over the coming years in order to improve the company’s capability to respond to volatile market conditions.

2010 also saw an important innovation – the launch of the DRYVAC fore-vacuum pump platform. Over 500 DRYVAC pumps and pumping systems were ordered in 2010. Apart from driving product innovation, Oerlikon Vacuum expanded its service network in Asia in order to improve on customer proximity. Three new service centers were opened, one in Hsin Chu, Taiwan, the second in Kulim, Malaysia, and the third extended the servicing capacities of the Tianjin, China, factory.

Key topics

Asia footprint: To unlock Asia's future growth potential, Oerlikon Vacuum is expanding the production and manufacturing footprint of the factory in Tianjin.

Innovation: Sustained high performance is key in manufacturing plants. The new vacuum pump series DRYVAC enables customers to manage their production systems and processes more efficiently and profitably. The platform-based technology of the new DRYVAC series ensures future technological flexibility to turn market demands into product features in a very short time and will contribute to the development of a whole suite of new pump lines in the future.

Expanding solutions business: Oerlikon Vacuum is improving its ability to integrate relevant vacuum know-how into specialized solutions in order to enhance customer benefits and thus the Segment’s competitive advantage. Oerlikon Vacuum is focusing on aligning operations and processes with the volatile market demand, as well as fine-tuning the management of the supply chain internationally. This entails a reduction in lead times and augments responsiveness to customer demands. After-sales services and special customer consultancy will gain importance and complement the global vacuum technology offerings of Oerlikon Vacuum.

Outlook

In 2011, market demand is expected to slow down, however sales are expected to remain stable. Again, Asian markets will probably serve as growth engines, driven by coating and energy applications as well as metallurgy. As a result, Asia will be a major focus for the Segment, with an emphasis on improving product availability, customer support and aftersales services.

Leveraging the DRYVAC platform approach, Oerlikon Vacuum is planning to launch another new product line in the second quarter of 2011. Upcoming markets such as thin film applications, solar and LED/OLED applications are also expected to contribute to growth in the coating industry in 2011.

The introduction of new technological platforms and entry into new markets is likely to have a positive impact on Oerlikon Vacuum's competitiveness in 2011. Profitability is expected to increase further.

download (PDF-File): Oerlikon Leybold Annual Report 2010

For more information, contact:

OC Oerlikon Corporation AG, Pfäffikon - www.oerlikon.com/ir

- Churerstrasse 120, CH–8808 Pfäffikon SZ

Burkhard Böndel, Corporate Communications

email: pr@oerlikon.com, Tel. +41 58 360 96 02

Graham Corporation Receives Orders totaling approximately $6.5 million

Graham Corporation (NYSE Amex: GHM) a designer and manufacturer of critical equipment for the oil refining, petrochemical and power industries, including the supply of components and raw materials to nuclear power plants, today announced that it has been awarded five orders totaling approximately $6.5 million.

Three of the five orders are for the renewable energy market. The first renewable energy sector order is for ejectors, condensers and liquid ring vacuum pumps for installation in a geothermal plant in Southeast Asia, with delivery planned for the third fiscal quarter of the fiscal year ending March 31, 2012, referred to as Fiscal 2012. The other two renewable energy sector orders are for installation in biomass-to-energy facilities under construction in North America, with delivery planned for the fourth fiscal quarter of Fiscal 2012.

The remaining two orders are for the oil refining market. These orders involve the supply of ejector systems to a U.S. and an Asian refiner. Each refining project is for the expansion of an existing oil refinery, with both deliveries planned for the third fiscal quarter of Fiscal 2012.

James R. Lines, Graham’s President and Chief Executive Officer, commented, “These five orders are a continuation of the spurt of activity from our traditional markets. We continue to secure orders in the expanding renewable energy market, which appears to be fairly active at this time. We believe that we have done well this quarter by capitalizing on opportunities where purchase decisions are being made. We believe that our sales approach, and the commitment by the entire company to win these orders within the schedule commitments of our customers, is testament to our flexibility, capability, focus on execution and customer-oriented service approach.”

“While we expect to continue to see strong order activity, we remain somewhat cautious and recognize that order flow will continue to be erratic given the current global economic and political uncertainty,” Mr. Lines concluded.

For more information contact:

Graham Corporation - www.graham-mfg.com

Jeffrey Glajch, Vice President Finance and CFO, email: jglajch@graham-mfg.com, Tel. +1 (585) 343-2216

Controlled Bake-out in Vacuum (Heating Solution)

Jena, Germany - Feb. 22, 2011

VACOM offers reliable, application-proven and innovative vacuum technology for your application from atmosphere to ultra-high vacuum. Customised solutions to measure and regulate your vacuum process are our strength:

New in our product range: Controlled Bake-out in Vacuum (Heating Solution) - a package consisting of software and hardware to control heating devices on your system. We offer four stages of expansion with up to eight heating elements. The heating elements are tailored to your application and can be freely selected from the VACOM product range; customised solutions are available on request. Of course, you have the possiblity to choose a target temperature for every heating tape to which it should be adjusted. Alternatively, you can use the system to measure and monitor the temperature of the outside of the chamber during your process. The measured values are recorded automatically in an ASCII file. For an optimal usage of your time, the program allows you to end the heating process after a time set by you, so that you can, for example, carry out your process or experiment in a cooled-down state on the next day.

|

We would be pleased to customise our standard software to your requirements in order to increase the efficiency of your system and reduce your workload. We will gladly send you a free solution proposal customised to your requirements.

VACOM Vakuum Komponenten & Messtechnik GmbH - www.vacom.de

- Gabelsbergerstraße 9, 07749 Jena, Deutschland

email: info@vacom.de, Tel. +49 (0)3641 4275-0

news

news

neu

neu

actu

actu

Your Press Release

Are you lauching a new product ? Did your company built a new plant ? delivered an important piece of equipment? agreed to a distribution agreement ?

Publish your article, post your news release, email now to: info@vacuum-guide.com

Your Diary

conferences, meetings, exhibitions

Projets

Career

job search, offers,