|

news, people, new vacuum pumps, mergers and acquisition

to the latest news Gardner Denver, Inc. Reports Continued Strong Revenue and Net Income Growth QUINCY, Ill., Oct. 25, 2006 Gardner Denver, Inc. announced that revenues and net income for the three months ended September 30, 2006 were $414.0 million and $32.1 million, respectively. "...Although I expect our rate of growth to begin to slow in 2007, demand for compressor and vacuum products remains broad-based, both regionally and across product lines. In the third quarter, we began to see some increased demand for engineered products in North America. We believe we have gained share in compressor and vacuum product market segments, particularly in Europe and Asia where results continue to improve," said Ross J. Centanni, Chairman, President and CEO. more Ingersoll Rand Acquires the Global Low-pressure Air Business of BOC Edwards including Hibon, Wilhelm Klein and Hick Hargreaves Hamilton, Bermuda, October 2, 2006 Ingersoll-Rand Company Limited (NYSE:IR), a leading diversified industrial company, today announced that it has acquired the global low-pressure air business (the "pressure business") of BOC Edwards, a business of The Linde Group. The acquisition is not connected with the impending divestment of BOC Edwards' equipment businesses announced by Linde in early September. more

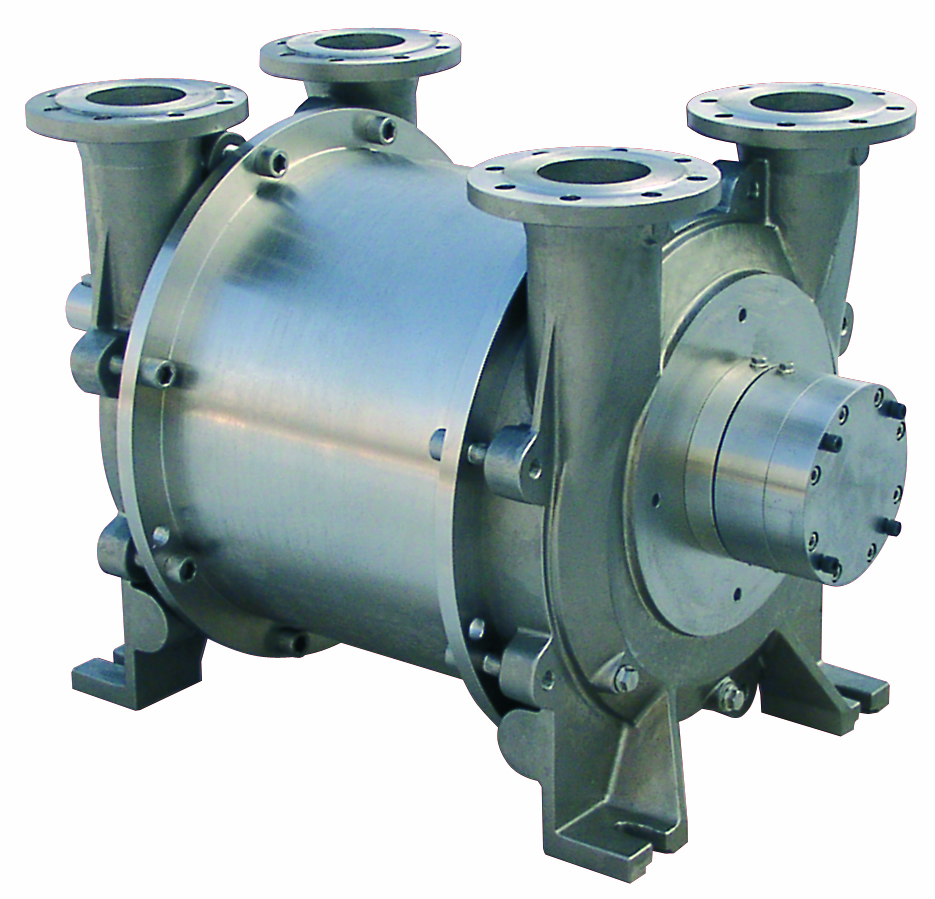

BOC Edwards launches EV range of single-stage rotary vane pumps August 15, 2006 BOC Edwards, has launched a new range of single-stage rotary vane pumps. The EV range offers reliable, high-speed low-pressure performance suitable for a wide range of applications including furnaces, vacuum drying, thermoforming, food processing and packaging. more Graham Corporation Reports 33.6% Revenue Growth for Fiscal Year 2006 June 5, 2006 BATAVIA, N.Y. - June 5, 2006 Graham Corporation today reported results for its fourth quarter and fiscal year ended March 31, 2006. Net sales for fiscal 2006 were $55.2 million, a 33.6% increase over net sales of $41.3 million for the fiscal year ended March 31, 2005. more Busch Group Acquires Graham Vacuum Technology Ltd May 15th, 2006 Busch Group, the international vacuum pump manufacturer, has acquired the business of UK based Graham Vacuum Technology Ltd. more GARDNER DENVER, INC. REPORTS RECORD LEVEL REVENUES AND EARNINGS April 26, 2006 Momentum Continues to Build Through Organic Growth, Pricing, Lean Initiatives and Benefit of Acquisitions... ...intend to merge the Rietschle and Wittig operations, which are both located in Schopfheim, Germany, ...relocate the mobile product line from Wittig to our facility in the U.K. ...rationalize the side channel blower product line, acquired as part of Nash Elmo, and centralize the production of standard products in the Elmo manufacturing facility in Bad Neustadt, Germany. ...shifting liquid ring pump production from Nuremberg, Germany to China and Brazil. more

Angstrom Sciences Appoints MidWestern Representative Jan. 2006 Alan Burrill of ALAN BURRILL TECHNICAL SALES was hired to cover the states of Illinois and Missouri.... more Angstrom Sciences Hires Production Planner to Implement New ERP System Jan. 2006 Angstrom Sciences announces the appointment of Mark Bates to the position of Production Planner... more Ingersoll Rand Acquires the Global Low-pressure Air Business of BOC Edwards including Hibon, Wilhelm Klein and Hick Hargreaves Hamilton, Bermuda, October 2, 2006 Ingersoll-Rand Company Limited (NYSE:IR), a leading diversified industrial company, today announced that it has acquired the global low-pressure air business (the "pressure business") of BOC Edwards, a business of The Linde Group. The acquisition is not connected with the impending divestment of BOC Edwards' equipment businesses announced by Linde in early September. "This acquisition augments our leadership as a global provider of innovative and comprehensive compressed air solutions," said Herbert L. Henkel, chairman, president and chief executive officer for Ingersoll Rand. "Through this transaction, we will be able to extend the range of innovative compressed air technologies and services we can provide to diverse markets, such as industrial, environmental, transportation and power, as well as widen our global distribution network." Under terms of the agreement, Ingersoll Rand has acquired the equity of BOC Edwards' businesses Hibon, Inc., in Montreal, and Wilhelm Klein GmbH, in Esslingen, Germany. The company also has purchased related business assets, including the Hibon, Wilhelm Klein and Hick Hargreaves low-pressure air lines, and employees operating in Brussels, Roubaix, France, and Bolton, the United Kingdom. Additional terms were not disclosed. The pressure business develops, manufactures, sells and services a complete line of multistage centrifugal blowers and industrial and mobile positive-displacement blowers, complementing Ingersoll Rand's existing line of compressed air technologies and services. Blowers are used to pneumatically convey liquids and powders in transportation and industrial applications, and have diverse applications in wastewater and power industries. The pressure business will operate as part of Ingersoll Rand Air Solutions, a business unit of Ingersoll Rand's Industrial Technologies Sector. BOC Edwards is a member of The Linde Group. A world leader in vacuum technology for industrial, scientific, process and semiconductor applications, the business designs, manufactures and supports equipment capable of achieving high vacuums down to 10-10 mbar. In addition to vacuum pumps and systems, BOC Edwards partners with semiconductor fabs, foundries and process tool manufacturers, to provide process-enabling subsystems, supported by best-in-class operations and maintenance services worldwide. The business employs around 4600 people worldwide. Specific information on BOC Edwards can be found at www.bocedwards.com. The Linde Group is a world leading industrial gases and engineering company with more than 53,000 employees working in around 70 countries worldwide. Following the acquisition of The BOC Group the company has gases and engineering sales of approximately €12 billion. The strategy of The Linde Group is geared towards earnings-based growth and focuses on the expansion of its international business with forward-looking products and services. For more information, please see The Linde Group online at www.linde.com. Ingersoll Rand is a leading diversified industrial company providing products, services and integrated solutions to industries ranging from transportation and manufacturing to food retailing, construction, and agriculture. With a 135-year-old heritage of technological innovation, we help companies worldwide to be more productive, efficient and innovative. In every line of our business, Ingersoll Rand enables companies and their customers to create progress. For more information, visit www.ingersollrand.com. This news release includes "forward-looking statements" as defined in the Private Securities Litigation Reform Act of 1995 with respect to our financial condition, results of operations and business. These statements are based on currently available information and are based on our current expectations and projections about future events. These statements are subject to risks and uncertainties that could cause actual results, performance or achievements to differ materially from anticipated results, performance or achievements. These risks and uncertainties include, but are not limited to: fluctuations in the condition of, and the overall political landscape of, the economies in which we operate; our competitive environment; material changes in technology or technology substitution; our ability to attract, train and retain highly-qualified employees; unanticipated climatic changes; changes in governmental regulation; the costs and effects of legal and administrative proceedings; changes in tax laws, tax treaties or tax regulations or the interpretation or enforcement thereof; currency fluctuations; our ability to complete acquisitions on financially attractive terms and successfully integrate them with our other businesses; and the impact of new accounting standards. Undue reliance should not be placed on such forward-looking statements as they speak only as of the date made. Additional information regarding these and other risks and uncertainties is contained in our periodic filings with the SEC, including, but not limited to, its report on Form 10-Q for the quarterly period ended June 30, 2006. Gardner Denver, Inc. Reports Continued Strong Revenue and Net Income Growth QUINCY, Ill., Oct. 25, 2006 -- Gardner Denver, Inc. GDI announced that revenues and net income for the three months ended September 30, 2006 were $414.0 million and $32.1 million, respectively. Diluted earnings per share (DEPS) were $0.60, 88% higher than the comparable period of 2005. The improvement in financial results for the three-month period reflects incremental profitability attributable to organic revenue growth, price increases and cost reductions, including acquisition integration activities. For the nine-month period of 2006, revenues and net income were $1.2 billion and $95.6 million, respectively. DEPS for the nine-month period of 2006 were $1.79, 103% higher than the comparable period of the previous year. Acquisitions contributed to the improvement in financial results for the nine-month period of 2006, compared to 2005, in addition to the organic growth, price increases and cost reductions mentioned previously. Current and prior year DEPS and all share amounts presented in this press release reflect the effect of the two-for-one stock split (in the form of a stock dividend) that was completed on June 1, 2006. CEO's Comments Regarding Results "I am proud of the overall efforts of our employees in achieving another successful quarter. Our results reflect continued strength in our end market segments and my outlook remains positive. Although I expect our rate of growth to begin to slow in 2007, demand for compressor and vacuum products remains broad-based, both regionally and across product lines. In the third quarter, we began to see some increased demand for engineered products in North America. We believe we have gained share in compressor and vacuum product market segments, particularly in Europe and Asia where results continue to improve," said Ross J. Centanni, Chairman, President and CEO. "I am also pleased with our operational improvements, including the inventory turnover improvements achieved this quarter as a result of previously completed lead-time reductions. In the third quarter, we continued to work with our suppliers to improve their performance and we completed the expansion of a manufacturing facility in China. The previously announced project to transfer production from Nuremberg, Germany to China and Brazil is expected to generate annualized savings in excess of $3 million beginning in the second quarter of 2007." "The rationalization of our European blower product lines and manufacturing facilities is well underway and the project remains on schedule and within budget. Through this project, we have merged the Rietschle and Wittig operations (located in Schopfheim, Germany) and are in the process of relocating the mobile blower product line from Wittig to a Gardner Denver facility in the U.K., where other European mobile equipment is manufactured. In the fourth quarter of 2006, we expect to complete the rearrangement of the manufacturing facility in the U.K. and the installation of new machine tools required to increase output. As part of this project, we also plan to rationalize the Elmo and Rietschle side-channel blower product lines and centralize production of standard products. By the fourth quarter of 2007, when the integration project is scheduled for completion, common manufacturing processes will have been implemented to increase productivity and reduce lead- times and inventory. We also expect to reduce administrative and manufacturing overhead expenses. Once completed, this project is expected to reduce costs by approximately $6.4 million annually and add manufacturing capacity." "Compared to the third quarter of 2005, we increased manufacturing output, revenues and segment operating margin(1) (for a reconciliation of segment operating earnings to consolidated income before income taxes, see "Business Segment Results.") while concurrently executing our integration projects. As a result of improved profitability and asset management, our return on equity (defined as net income divided by average equity) has increased to 16.5% (on an annualized basis) for the third quarter of 2006, compared to 10.6% (annualized) in the third quarter of 2005." Outlook "The Company expects orders for its compressor and vacuum products to remain strong through the remainder of 2006 and the rate of order growth for these products to begin to slow in 2007 from the current double-digit level. We anticipate revenue growth to continue in 2007 through a combination of the order growth and some reduction in backlog as operational improvements are achieved and integration projects are completed. During the third quarter of 2006, we experienced improved demand for engineered products in North America, primarily for geothermal applications and environmental projects. Lead-times associated with engineered products typically exceed those of more standard products, providing the Company more visibility into 2007 revenues. The economic environment in Europe and Asia also remains strong. We continue to experience good demand for our petroleum pumps and are currently taking orders for delivery of these products in the second half of 2007, also contributing to our visibility and favorable outlook. Further revenue increases for oil and natural gas-related products will depend upon our ability to identify additional outsourcing alternatives, implement incremental price increases and add machining capacity through selective capital investment." "As expected, integration activities and fewer production days negatively impacted the Company's operating earnings in the third quarter of 2006, compared to the second quarter of 2006. The integration activities resulted in lower productivity and increased severance expenses in the Compressor and Vacuum Products segment compared to the prior quarter. As a result of annual vacation shut-downs at several of our manufacturing facilities in the third quarter, production levels decreased and fixed expenses represented a greater percentage of revenues, which contributed to lower sequential operating margin in both reportable segments. The annual plant shut-downs present an opportune time to complete capital projects and significant repair and maintenance projects. Therefore, incremental spending was incurred during the shut-down period, also contributing to lower sequential operating margins in both reportable segments. We expect costs associated with the integration projects to further impact financial results in the fourth quarter of 2006 and decline in 2007 until the projects are completed in the fourth quarter of the year. The holiday period in the fourth quarter will negatively impact operating margins in both reportable segments, but we expect consolidated results to be comparable to the third quarter," noted Mr. Centanni. "Based on our current economic outlook, existing backlog, and expected operational improvements as integration projects are completed, we are increasing our DEPS outlook for 2006 to a range of $2.35 to $2.45, with fourth quarter DEPS approximating $0.56 to $0.66. The current estimate assumes that approximately $2.0 million to $2.5 million of severance and relocation expenses ($0.02 to $0.03 DEPS) are incurred in the fourth quarter as a result of integration projects. The midpoint of the range for 2006 ($2.40) represents a 75% increase over 2005 results. This improvement is expected despite the $0.07 reduction in DEPS associated with recognizing stock-based compensation expense for the year in accordance with SFAS 123(R), a greater number of average shares outstanding for the twelve-month period of 2006 (compared to 2005) and a higher effective tax rate. The implementation of SFAS 123(R) is expected to reduce net income by $0.6 million ($0.01 DEPS) in the fourth quarter of 2006. Based on current expectations for the sources and magnitude of earnings in 2006, the effective tax rate assumed in the DEPS guidance for 2006 is 33%." "DEPS in 2007 are currently expected to be in a range of $2.60 to $2.90. Achieving the midpoint of this range ($2.75) would represent the fourth consecutive year of double-digit DEPS growth. The improvement in DEPS is projected despite an expected increase in the Company's effective tax rate to 34% in 2007. The increase in the effective tax rate is primarily a result of higher levels of pretax income expected in the U.S. and Germany in 2007, which are taxed at higher rates than the Company's effective average for 2006 (33%). Tax planning strategies are also expected to provide decreasing rate benefits as the Company's pretax earnings increase." Third Quarter Results Revenues increased $57.9 million (16%) to $414.0 million for the three months ended September 30, 2006, compared to the same period of 2005. Compressor and Vacuum Products segment revenues increased 10% for the three- month period of 2006, compared to the previous year, primarily due to stronger demand, favorable changes in currency exchange rates and price increases. Fluid Transfer Products segment revenues increased 44% for the three months ended September 30, 2006, compared to the same period of 2005, primarily due to stronger demand for drilling and well servicing pumps, manufacturing and supply chain improvements, incremental shipments as a result of increased outsourcing, price increases and acquisitions. (See Selected Financial Data Schedule.) Compressor and Vacuum Products orders for the three-month period ended September 30, 2006 were $45.4 million (15%) higher than the same period of the previous year due to organic growth, price increases and favorable changes in exchange rates. Backlog in this reportable segment increased for the eleventh consecutive quarter and was 23% higher than September 30, 2005. As expected, orders for Fluid Transfer Products were lower in the third quarter of 2006 than the same period of the previous year due to the timing of bookings for drilling pumps and loading arms. The level of orders in the third quarter of 2005 was unusually high and represented 192% of revenues for that quarter as customers for oil and natural gas products began securing future production capacities. At present, customers for petroleum pump products remain optimistic in their outlook and demand expectations for 2007 and are inquiring about incremental capacity the Company will have available next year. The slight decline in backlog for Fluid Transfer Products compared to the second quarter of 2006 is attributable to the timing of orders for loading arms. Backlog for petroleum products remained relatively constant over the most recent three-month period. Cost of sales (excluding depreciation and amortization) as a percentage of revenues decreased to 65.6% in the three-month period ended September 30, 2006, from 67.5% in the same period of 2005. This improvement was attributable to cost reduction initiatives, leveraging fixed and semi-fixed costs over additional production volume and favorable sales mix. The third quarter of 2006 included a higher percentage of drilling pump and replacement pump parts shipments than the previous year and these products have cost of sales (excluding depreciation and amortization) percentages below the Company's average. Finally, cost of sales (excluding depreciation and amortization) for the three-month period of 2005, included approximately $3.9 million of non- recurring costs attributable to recording inventory of acquired businesses at fair value. Declines in productivity related to acquisition integration efforts completed in 2006 partially offset some of these improvements. Depreciation and amortization increased $1.7 million (15%) to $13.0 million, primarily due to the incremental depreciation and amortization associated with capital investments and the effect of finalizing the fair market value of Thomas Industries' tangible and amortizable intangible assets. As a percentage of revenues, selling and administrative expenses decreased to 17.8% for the three-month period ended September 30, 2006, compared to 20.0% for the same period of 2005 as a result of cost control initiatives and leveraging the benefit of the revenue growth. Selling and administrative expenses increased $2.7 million in the three-month period ended September 30, 2006 to $73.8 million, primarily due to the incremental effect of stock-based compensation expense ($1.0 million), severance and integration costs ($1.1 million) and salary and benefit expense increases. These increases were partially offset by cost reductions realized through completed integration initiatives. As a result of the improved cost of sales (excluding depreciation and amortization) percentage and leveraging selling and administrative expenses over higher revenues, operating earnings(1) (for a reconciliation of segment operating earnings to consolidated income before income taxes, see "Business Segment Results.") as a percentage of revenues (operating margin) for each reportable segment improved for the three-month period ended September 30, 2006, compared to the same period of 2005. Compressor and Vacuum Products segment operating margin was 10.2% in the three months ended September 30, 2006, compared to 7.8% in the same period of 2005. Fluid Transfer Products segment operating margin increased to 25.4% for the three months ended September 30, 2006, compared to 16.7% in the same period of 2005. Debt repayments over the previous twelve months resulted in lower interest expense for the three months ended September 30, 2006, compared to the same period of 2005, despite higher short-term interest rates. Net income for the three months ended September 30, 2006 increased $15.5 million (93%) to $32.1 million, compared to $16.7 million in same period of 2005, despite the inclusion of stock-based compensation expense and a higher effective tax rate in 2006 (33%) than in 2005 (30%). DEPS for the three-month period of 2006 were $0.60, 88% higher than the comparable period of the previous year as a result of the increased net income. Nine Month Results Revenues for the nine-month period of 2006 increased $384.3 million (45%) to $1.2 billion, compared to the same period of 2005, due to acquisitions, organic growth and price increases. (See Selected Financial Data Schedule.) Net income for the nine months ended September 30, 2006 increased $54.0 million (130%) to $95.6 million ($1.79 DEPS), compared to $41.6 million ($0.88 DEPS) in same period of 2005. This increase was primarily attributable to organic revenue growth and price increases, cost reductions (including those associated with integrating previously acquired businesses) and acquisitions (net of interest expense related to financing the purchase price). DEPS for the nine months ended September 30, 2006 were reduced $0.06 due to the recognition of stock-based compensation expense in accordance with SFAS 123(R). Compared to the previous year, DEPS for 2006 were also reduced as a result of having a greater number of average shares outstanding and a higher effective tax rate. Cash provided by operating activities was approximately $86.7 million in the nine-month period of 2006, 64% more than $52.8 million generated in the same period of 2005. The timing of shipments resulted in higher receivable balances, but Days Sales Outstanding were 59, similar to the level as of September 30, 2005, and inventory turnover was 4.8 times in the three-month period of 2006. Continued focus on lean initiatives, additional supplier performance improvement and execution of the integration plans are expected to result in further improvement in inventory turnover. The Company invested approximately $26.3 million in capital expenditures in the nine-month period of 2006, compared to $22.7 million in the same period of 2005. The higher spending in 2006 reflects incremental investments in acquisition integration, cost reductions and capital spending at Thomas Industries' operations. Capital spending is currently expected to be approximately $40 million to $45 million in 2006, and will be used primarily to integrate businesses and improve operations. In addition to capital expenditures and acquisition payments, cash provided by operations was used to repay debt. Total debt as of September 30, 2006 was $491.2 million, $77.5 million less than total debt as of December 31, 2005. As of September 30, 2006, debt to total capital was 38.1%, compared to 46.4% on December 31, 2005. Cautionary Statement Regarding Forward-Looking Statements All of the statements in this release, other than historical facts, are forward-looking statements made in reliance upon the safe harbor of the Private Securities Litigation Reform Act of 1995, including, without limitation, the statements made under the "CEO's Comments Regarding Results", "Outlook" and "Nine Month Results" sections. As a general matter, forward- looking statements are those focused upon anticipated events or trends, expectations, and beliefs relating to matters that are not historical in nature. Such forward-looking statements are subject to uncertainties and factors relating to the Company's operations and business environment, all of which are difficult to predict and many of which are beyond the control of the Company. These uncertainties and factors could cause actual results to differ materially from those matters expressed in or implied by such forward-looking statements. The following uncertainties and factors, among others, could affect future performance and cause actual results to differ materially from those expressed in or implied by forward-looking statements: (1) the ability to effectively integrate acquisitions, including product and manufacturing rationalization initiatives, and realize anticipated cost savings, synergies and revenue enhancements; (2) the risk that the Company may incur significant cash integration costs to achieve any such cost savings; (3) the Company's exposure to economic downturns and market cycles, particularly the level of oil and natural gas prices and oil and gas drilling and production, which affect demand for the Company's petroleum products, and industrial production and manufacturing capacity utilization rates, which affect demand for the Company's compressor and vacuum products; (4) the risks of large or rapid increases in raw material costs or substantial decreases in their availability, and the Company's dependence on particular suppliers, particularly iron casting and other metal suppliers; (5) the risks associated with intense competition in the Company's markets, particularly the pricing of the Company's products; (6) the Company's ability to continue to identify and complete other strategic acquisitions and effectively integrate such acquisitions to achieve desired financial benefits; (7) economic, political and other risks associated with the Company's international sales and operations, including changes in currency exchange rates (primarily between the U.S. dollar, the Euro, the British pound and the Chinese yuan); (8) changes in the availability or costs of new financing to support the Company's operations and future investments; (9) the risks associated with pending asbestos and silicosis personal injury lawsuits, as well as other potential product liability and warranty claims due to the nature of the Company's products; (10) the risks associated with environmental compliance costs and liabilities; (11) the ability to attract and retain quality management personnel; (12) the ability to avoid employee work stoppages and other labor difficulties; (13) the risks associated with defending against potential intellectual property claims and enforcing intellectual property rights; (14) market performance of pension plan assets and changes in discount rates used for actuarial assumptions in pension and other postretirement obligation and expense calculations; (15) the risk of possible future charges if the Company determines that the value of goodwill or other intangible assets has been impaired; and (16) changes in laws and regulations, including accounting standards, tax requirements and related interpretations or guidance. The Company does not undertake, and hereby disclaims, any duty to update these forward-looking statements, although its situation and circumstances may change in the future. Comparisons of the financial results for the three and nine-month periods ended September 30, 2006 and 2005 follow. Gardner Denver will broadcast a conference call to discuss third quarter earnings on Thursday, October 26, 2006 at 9:30 a.m. Eastern time through a live webcast. This free webcast will be available in listen-only mode and can be accessed, for up to ninety days following the call, through the Investor Relations page on the Gardner Denver website ( http://www.gardnerdenver.com ) or through Thomson StreetEvents at http://www.earnings.com . Gardner Denver, Inc., with 2005 revenues of $1.2 billion ($1.4 billion on a pro forma basis including the acquisition of Thomas Industries, which was completed in July 2005), is a leading worldwide manufacturer of reciprocating, rotary and vane compressors, liquid ring pumps and blowers for various industrial and transportation applications, pumps used in the petroleum and industrial markets, and other fluid transfer equipment serving chemical, petroleum, and food industries. Gardner Denver's news releases are available by visiting the Investor Relations page on the Company's website www.gardnerdenver.com Volotek unveils the world’s highest precision Vacuum Gauge Controller Company expects to extend even higher the range of its precision measuring instruments for specialized industries. Geneva, Switzerland, August 15th 2006 Volotek SA, a leading supplier of high precision scientific instruments is launching its new VGC1000 Vacuum Gauge Controller after successful delivery and installation at CERN (European Organization for Nuclear Research) for the LHC accelerator and LEIR accumulator. Volotek pushes the limit with its new VGC1000 Vacuum Gauge Controller to deliver the world highest precision controller offering scalability, reliability and high stability in the Extreme High Vacuum (XHV) measurements range of 10-16 bar. The VGC1000 controller is a modular 1/3 rack 3U high, economical, single-channel controller that has been designed to be flexible, user-friendly and to provide fast reliable pressure measurements that exceeds any other controller on the market. All of the operating controls and settings are conveniently accessible from the front panel of the controller or remotely via the integrated Profibus DP interface. The VGC1000 has a low noise integrated Electrometer module with sensitivity in the range of 1 fA (1 fA=10-15 Amp) delivering high accuracy pressure readings into the XHV range. The internal modularity of the VGC1000 controller allows the replacement of the Profibus interface with other optional control and communication interfaces such as RS-232, RS-485 and Ethernet which gives the possibility to control it via the LAN or the internet. - CERN, the world's largest particle physics research organization - (LHC) Large Hadron Collider, a 17-mile long, high energy particle accelerator - (LEIR) Low Energy Ion Ring, as an ion accumulator for LHC www.volotek.com BOC Edwards launches EV range of single-stage rotary vane pumps Leading manufacturer of vacuum equipment, BOC Edwards, has launched a new range of single-stage rotary vane pumps. The EV range offers reliable, high-speed low-pressure performance suitable for a wide range of applications including furnaces, vacuum drying, thermoforming, food processing and packaging. Some of the smaller pumps, such as the EV20 and EV40, are also suitable for use in scientific applications. A combination of proven, low-maintenance rotary vane technology and environmentally-aware design, BOC Edwards brings to market an economical single-stage vacuum solution for industry. Unlike some competitive products the EV range provides continuous operation from atmosphere to ultimate vacuum. This, coupled with good water vapour tolerance of up to 6 kg/h at 10 mbar, ensures a consistent, un-interrupted process. Other key benefits include low vibration and noise even on the largest EV630 pump (less than 80 dB(A) at 50 Hz) and highly efficient mist filters that ensure minimal oil discharge from the exhaust - providing economical operation and environmental protection. All pumps are air cooled, saving the capital and operating costs associated with providing cooling water. Pumps can be supplied individually (there are nine variations offering a scale of speeds from 20 to 630 m3/h) or as part of a pre-engineered combination with BOC Edwards proven ranges of EH or MB mechanical boosters to increase pumping speed and ultimate vacuum. Dual frequency, wide band motor options ensure compatibility with power sources worldwide. www.bocedwards.com Graham Corporation Reports 33.6% Revenue Growth for Fiscal Year 2006 BATAVIA, N.Y.--(BUSINESS WIRE)--June 5, 2006--Graham Corporation (AMEX: GHM): -- Income from continuing operations up $6.5 million over prior year -- Operating margin improves to 11.1% for fiscal year 2006 -- Fourth quarter sales up 20.6% from prior year fourth quarter -- Charge of $0.06 per share for successful settlement of brand name protection suit impacts fourth quarter -- Fourth quarter orders grow to $18.6 million Graham Corporation (AMEX: GHM) today reported results for its fourth quarter and fiscal year ended March 31, 2006. Net sales for fiscal 2006 were $55.2 million, a 33.6% increase over net sales of $41.3 million for the fiscal year ended March 31, 2005. Net sales for the fourth quarter grew 20.6% to $15.9 million compared with net sales of $13.2 million in the same prior-year period. The higher level of net sales for the quarter and year were primarily the result of growth in demand for Graham products as oil and petrochemical companies continued to expand capacity to address increasing consumer demand. International net sales were $27.3 million for fiscal 2006 compared with $16.3 million for fiscal 2005. The increase in international net sales were primarily to customers in the Middle East as refinery and petrochemical capacity in that region continued to expand to meet growing demand from Asia. Net income for fiscal 2006 was $3.6 million, or $0.96 per diluted share, a $3.3 million and $6.5 million increase over income from continuing operations of $0.3 million and net loss of $2.9 million in fiscal 2005, respectively. The fourth quarter of fiscal 2006 also included a charge of $371 thousand, or approximately $0.06 per share, related to the successful settlement of a brand name infringement case Graham pursued against a foreign pump manufacturer. For the fourth quarter of fiscal 2006, income from continuing operations was $973 thousand up 31% over income from continuing operations of $743 thousand in the prior fiscal year and up $3.3 million from fourth quarter fiscal 2005's net loss, after recognizing a loss for the discontinuance of a foreign wholly-owned subsidiary of $3.0 million, of $2.3 million. Earnings per diluted share were $0.25 for the fourth quarter of fiscal 2006 compared with income from continuing operations of $0.21 per diluted share and a net loss of $0.65 per share in the prior year's fourth quarter. William C. Johnson, President and CEO of Graham, commented, "The excellent results we achieved in fiscal 2006 can be attributed to a combination of strong growth in our markets, the significant number of projects we sold due to the value of our brand and quality of our product, and our successful efforts to expand our engineering production capability. We believe that similar economic conditions exist as we head into fiscal 2007, and we are continuing to expand our capacity to capitalize on the strength of our markets." Fourth Quarter Review International net sales for the fourth quarter of fiscal 2006 were $8.7 million, up $3.4 million from the same period in the prior year. For the fourth quarter of fiscal 2006, gross margin was 27.6%, a 3.1 percentage point improvement over gross margin of 24.5% in the fourth quarter of the prior year as a result of higher sales volume which more than offset increased production costs resulting in improved gross profit. Sequentially from the third quarter of fiscal 2006, gross margin improved in the fourth quarter by 1 percentage point as a result of higher volume. For the fourth quarter, selling, general and administrative expenditures ("SG&A") were $2.3 million, or 14.4% of sales, compared with $1.8 million, or 13.5%, of sales in the same quarter last year. The $500 thousand increase was a result of spending to develop business in Asia, Europe and the Middle East, as well as increased variable compensation due to higher earnings. Compared with the third quarter of fiscal 2006, SG&A was down $442 thousand, due to an overall reduction in spending. Operating margin for the fourth quarter was 13.3%, an increase from 11.0% in the same period the prior year. Fiscal 2006 Review Net sales for fiscal 2006 by geographic area were approximately 60% to North America, 16% to Asia, 14% to the Middle East, and 10% to the rest of the world. This compares with net sales in fiscal 2005 of 70% to North America, 15% to Asia, 4% to the Middle East and 11% to the rest of the world. Net sales for fiscal 2006 by market were approximately 42% to oil refinery projects, 24% to chemical and petrochemical projects and 14% to power projects. The remaining 20% of net sales were for other industrial or commercial applications. This compares with fiscal 2005 net sales of 26% to oil refinery projects, 31% to chemical and petrochemical projects, 7% to power projects and 36% to other applications. The significant change in Graham's market and geographic sales mix in fiscal 2006 reflects the ongoing expansion of Middle East refinery and petrochemical plant capacity. Gross margin was 28.9% for fiscal 2006, compared with 18.2% for fiscal 2005. Increased sales volume, product mix and increased selling prices contributed to improved gross margin. SG&A expenditures decreased to 17.8% of sales compared with 18.6% in the prior fiscal year. On an absolute basis, SG&A increased $2.1 million in fiscal 2006 to $9.8 million compared with $7.7 million in fiscal 2005. The increase on an absolute basis was a result of increased travel, consulting, variable compensation expenses and the addition of sales personnel in Europe and China to support increased international sales opportunities. Operating margin for fiscal 2006 was 11.1%, an improvement from a slight operating loss for fiscal 2005. Liquidity For the full fiscal year, net cash generated by operating activities was $6.5 million in 2006 compared with net cash used by continuing operations of $4.4 million in 2005. The improvement was due to net income of $3.6 million for the year compared with a net loss in fiscal 2005, a deferred income tax provision of $2.2 million and strengthened cash management through various initiatives established in fiscal 2006. Capital expenditures for fiscal 2006 were $1.0 million compared with $224 thousand in fiscal 2005. This included computer hardware and software necessary to increase engineering capacity, safety equipment and general spending. Depreciation and amortization for the fiscal year 2006 was $793 thousand, up slightly from $780 thousand in fiscal 2005. Stockholders' Equity Stockholders' equity increased $10.5 million, or 64%, in fiscal 2006 compared with the prior fiscal year. Positive net income of $3.6 million contributed 34% to this increase. Proceeds from the third quarter sale of 198,246 shares of common stock held as treasury shares added $3.4 million, or 32%. Net book value increased to $7.07 per share at March 31, 2006, up from $4.88 per share at the same time last year. Orders and Backlog Orders received during fiscal 2006 were $66.2 million compared with $49.9 million in fiscal 2005, a 33% increase. Surface condenser orders increased 50% and ejector orders increased 31% year-over-year, in each case primarily as a result of a higher level of demand from the oil refining and petrochemical markets. Export orders for the year were up 59% with 80% of this increase for orders in the Middle East for petrochemical plants. Domestic orders increased 10% during fiscal 2006 compared with the prior year primarily as a result of oil refinery equipment upgrades necessary to enable facilities to process lower-priced sour crude oil and to meet environmental regulatory requirements. For fiscal 2006, orders were approximately 37.5% for refinery projects, 33.3% for chemical and petrochemical facilities, 21.2% for other industrial and commercial applications and 8% for power related projects. For the fourth quarter of fiscal 2006, orders were $18.6 million, up $5.3 million, or 39.8%, compared with the same prior year period. As of March 31, 2006, backlog was $33.1 million, up 48% from $22.4 million at March 31, 2005, and up 9.2% from $30.3 million at December 31, 2005. Most orders represented in backlog ship within twelve months of receipt of order. Approximately 40% of the backlog is related to refinery projects, 40% to chemical and petrochemical projects, 4% to power generation projects and 16% to a variety of other industrial and commercial applications. Due to the timing of the placement of orders by customers, Graham does not believe the normal fluctuations of bookings from quarter-to-quarter reflect its future sales potential. Rather, Graham believes that a six to twelve-month perspective of orders received provides a better indication of demand trends. Outlook Mr. Johnson continued, "We were able to increase our internal engineering capacity in fiscal 2006, and the results are reflected in the strong orders we recorded in the fourth quarter. Since opportunities for our equipment are abundant, continuing to increase engineering capacity remains a priority in fiscal 2007. We have relatively good visibility for the fiscal year because our order-to-ship cycle runs between six to twelve months. We now recognize that higher material costs will increase our earlier fiscal year 2007 projected sales of 25 to 30% over fiscal 2006 net sales, or to about $69 to $72 million, to grow approximately 35% to 45%, or to a range of $75 to $80 million. It is important to note that this change in our outlook is related directly to material price increases and not related to volume. The material price increase has the effect of lowering gross margin to approximately 27% for the year, although total gross profit increases. Our projected SG&A should remain around $12 million. The net effect is that operating margin for the upper end of our estimate improves slightly over previous expectations." Mr. Johnson concluded, "We have a long history of providing products to international projects. However, most of the contracts for these projects have historically been generated through U.S. based multi-national engineering and procurement contractors and global end-users, such as the large oil companies. We believe our future success will depend on our ability to build an operating base within those countries that have growing oil and petrochemical demand. Our recently formed Chinese subsidiary is intended to enable Graham to position itself as a multi-national company working with in-country engineering and procurement contractors and end-users. We are developing the framework of a new business model in order to build relationships with new customers and win internationally-based contracts at profitable levels." Webcast and Conference Call Graham's senior management team will host a conference call and webcast on June 5, 2006 at 5:00 p.m. eastern time to discuss Graham's results of operations for its fourth quarter and fiscal 2006 year-ended March 31, 2006. The webcast can be accessed at www.graham-mfg.com. Participants should go to the website approximately 10 to 15 minutes prior to the scheduled teleconference in order to register and download any necessary audio software. The teleconference can be accessed by calling (913) 981-5543 approximately 5 to 10 minutes prior to the call. A replay of the call will be available through June 12, 2006 at 11:59 p.m. eastern time at (719) 457-0820, by entering passcode 9946465. An archive of the webcast and a transcript of the teleconference will also be available at www.graham-mfg.com. ABOUT GRAHAM CORPORATION With world-renowned engineering expertise in vacuum and heat transfer technology, Graham Corporation is a designer, manufacturer and global supplier of ejectors, pumps, condensers, vacuum systems and heat exchangers. Over the past 70 years, Graham has built a reputation for top quality, reliable products and high-standards of customer service. Sold either as components or complete system solutions, the principle markets for Graham's equipment are the petrochemical, oil refining and electric power generation industries, including cogeneration and geothermal plants. Graham equipment can be found in diverse applications, such as metal refining, pulp and paper processing, ship-building, water heating, refrigeration, desalination, food processing, drugs, heating, ventilating and air conditioning. Graham's reach spans the globe. Its equipment is installed in facilities from North and South America to Europe, Asia, Africa and the Middle East. More information regarding Graham can be found at its website: www.graham-mfg.com Safe Harbor Statement This press release contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. Forward-looking statements are subject to risks, uncertainties and assumptions and are identified by words such as "expects," "estimates," "projects," "anticipates," "intends", "believes," "could," and other similar words. All statements addressing operating performance, events, or developments that Graham expects or anticipates will occur in the future, including statements relating to the Graham's anticipated revenues, foreign sales operations, its strategy to build its global sales representative channel and operations, the effectiveness of automation in expanding its engineering capacity, its ability to improve cost competitiveness, customer preferences and changes in market conditions in the industries in which Graham operates, the change in the competitive landscape, and other related factors are forward-looking statements. Because they are forward-looking, they should be evaluated in light of important risk factors and uncertainties. These and other risk factors and uncertainties are more fully described in Graham's Annual and Quarterly Reports filed with the Securities and Exchange Commission. Should one or more of such risks or uncertainties materialize, or should any of Graham's underlying assumptions prove incorrect, actual results may vary materially from those currently anticipated. In addition, undue reliance should not be placed on Graham's forward-looking statements. Except as required by law, Graham disclaims any obligation to update or publicly announce any revisions to any of the forward-looking statements contained in this press release. TABLES FOLLOW. see also: 2005 Annual report Busch Group Acquires Graham Vacuum Technology Ltd May 15th, 2006 - Busch Group, the international vacuum pump manufacturer, has acquired the business of UK based Graham Vacuum Technology Ltd. The business of Graham Vacuum Technology Limited is to be integrated into the business of the Busch Group and will be known as Busch GVT Limited. The move, announced today by Busch Group’s founder Dr.Ing. Karl Busch, is part of the company’s strategy to grow capabilities in liquid ring technology, in which the business of Graham Vacuum Technology Limited specialises. Dr Busch said: “The business of Graham Vacuum Technology has been established for more than 40 years and the synergy between the businesses is strong, including its values, quality standards and customer base. “It offers market leading products in liquid ring technology, as well as other vacuum pumps, which we can optimise with our international operations.” A new website has been launched at www.busch-gvt.co.uk and customers can contact the sales team at sales@busch-gvt.co.uk. Busch provides vacuum pumps, low-pressure compressors and systems to the chemical and pharmaceutical, environmental, water and waste, printing and food packaging. The acquisition of Graham will add oil and gas as well as the utilities markets to that list. Graham Vacuum Technology Ltd based in Congleton, Cheshire, UK has over 40 years manufacturing experience of liquid ring vacuum pumps as well as rotary piston pumps and dry vacuum pumps. Momentum Continues to Build Through Organic Growth, Pricing, Lean Initiatives and Benefit of Acquisitions Compared to the First Quarter of 2005: -- Revenues increase 67% -- Net income increases 196% -- Diluted earnings per share increases 130%, even with 29% more shares outstanding -- Total segment operating earnings increase 201% QUINCY, Ill., April 26 /PRNewswire-FirstCall/ -- Gardner Denver, Inc. (NYSE: GDI) announced that revenues and net income for the three months ended March 31, 2006 were $399.3 million and $30.5 million, respectively. These results represent record levels for the Company, exceeding the previous records achieved in the three-month period ended December 31, 2005. Diluted earnings per share (DEPS) for the three months ended March 31, 2006 was $1.15, 130% higher than the comparable period of the previous year, despite 29% more average shares outstanding in 2006 than in 2005 and the effect of recognizing stock-based compensation expense ($0.07 DEPS) in accordance with SFAS 123(R). The improved financial performance in 2006 is primarily attributable to flow- through profitability on strong organic revenue growth, price increases, cost reduction initiatives and the incremental benefit of acquisitions. CEO's Comments Regarding Results "In the first quarter of 2006, our financial performance reflected the efforts of our employees and channel partners. Demand continued to improve, especially for compressor and vacuum products, and our previous capital investments and lean manufacturing initiatives resulted in reduced lead times and increased productivity. Outsourcing some production also contributed to the revenue growth for fluid transfer products in the first quarter of 2006. As a result, we were able to increase output and achieve significant flow- through profitability on the organic revenue growth. This flow-through profitability resulted in total segment operating earnings as a percentage of revenues increasing to 13.6% for the three months ended March 31, 2006 from 7.6% for the same period of 2005. We continue to add value for our shareholders through increased earnings as we integrate our strategic acquisitions, generate organic revenue growth and complete cost reduction initiatives. The Company achieved a return on equity of 17.9% for the first quarter of 2006 compared to 15.6% for the fourth quarter of 2005," stated Ross Centanni, Chairman, President and CEO. "In April, we initiated the process of rationalizing our European blower product lines and manufacturing facilities. We intend to merge the Rietschle and Wittig operations, which are both located in Schopfheim, Germany, and relocate the mobile product line from Wittig to our facility in the U.K. where other European mobile equipment is manufactured. The operations that remain in Schopfheim will then focus on industrial blower applications. We also intend to rationalize the side channel blower product line, acquired as part of Nash Elmo, with Rietschle's similar product offering and centralize the production of standard products in the Elmo manufacturing facility in Bad Neustadt, Germany. Common manufacturing processes will be re-aligned to increase productivity and reduce our investment in inventory in both the U.K. and Germany. When this project is completed, which is expected to occur in the fourth quarter of 2007, we plan to have eliminated production constraints currently encountered at the Schopfheim facilities, reduced redundant administrative and manufacturing overhead and improved manufacturing productivity and lead time. This project is expected to eliminate approximately 65 positions in Schopfheim. "We continue to seek opportunities to reduce costs and sell excess assets as we further streamline our operations. In the first quarter of 2006, we sold a Thomas Industries distribution facility in the U.K., generating approximately .3.3 million (approximately $5.8 million) of cash. Our previously announced liquid ring pump manufacturing and product rationalization initiative involves shifting production from Nuremberg, Germany to China and Brazil. This project is on track to generate expected annualized savings in excess of $3 million beginning in the second quarter of 2007. To date, we have reached agreement with the local works council regarding redundancy obligations, ordered the necessary capital equipment and broken ground on a facility expansion in China. Additional synergistic benefits are expected as we further integrate the sales companies acquired as part of Syltone, Nash Elmo and Thomas Industries." Outlook "Our end markets have continued to improve and in the first quarter of 2006 we began to see some increased demand in certain segments, such as European mobile applications, that had previously been lagging. The Federal Reserve Board reported that total industry capacity utilization in the U.S. was at least 81% in both February and March 2006, which is a positive indicator of demand for our compressor and vacuum products. To meet the demand growth, we have been outsourcing certain manufacturing operations to relieve production bottlenecks and have invested in capital for longer-term solutions. Demand for our drilling and well stimulation pumps remains strong and we expect this to continue through 2007. Further revenue increases for these products will depend upon our ability to identify additional outsourcing alternatives and implement further price increases. "The first quarter results demonstrated the benefits of the production efficiency improvements and investments in lean manufacturing programs that we have been pursuing. I expect the benefit of these improvements to continue through 2006, although net income in the second half of 2006 is currently expected to be less than that of the first half of 2006 due to fewer production days in Europe and incremental expenses and manufacturing inefficiencies associated with our blower manufacturing rationalization project. I also believe our lean manufacturing techniques will contribute to inventory reductions over time," noted Mr. Centanni. "Given our current economic outlook, as well as our existing level of backlog and recent manufacturing improvements, we are increasing our DEPS outlook for 2006 significantly to a range of $4.05 to $4.25, with second quarter DEPS approximating $1.00 to $1.15. The midpoint of the range for 2006 ($4.15) represents a 51% increase over the 2005 results, despite the reduction in DEPS associated with recognizing stock-based compensation expense in accordance with SFAS 123(R) and a greater number of average shares outstanding for the twelve-month period of 2006, compared to 2005. The implementation of SFAS 123(R) is expected to reduce net income by $0.4 million in each of the remaining quarters of 2006 ($0.05 DEPS for the remainder of the year). Based on current expectations for the sources and magnitude of earnings in 2006, the effective tax rate assumed in the DEPS guidance for 2006 is 32%. The anticipated effective tax rate for 2006 is expected to increase from the rate incurred in the prior year (and our previous expectation for 2006) primarily as a result of incremental pretax income generated by the Company's operations in the United States and Germany in 2006, which are taxed at rates higher than the effective average of 2005 (30%). This outlook for DEPS does not reflect the two-for-one stock split (in the form of a stock dividend) that was previously approved by our Board of Directors. If stockholders approve the requested increase in the number of authorized shares of the Company's common stock necessary to complete the stock split, the record date for the split will be May 11, 2006 and the expected distribution date will be June 1, 2006." Revised Reportable Segment Composition The Company also announced a change in the composition of its reportable segments. The Company's line of specialty bronze and high alloy pumps for the general industrial and marine market segments, acquired in July 2005 as part of Thomas Industries Inc., and the Company's line of self-sealing couplings, acquired as part of Syltone plc in January 2004, were previously included in the Compressor and Vacuum Products segment from their respective dates of acquisition. Self-sealing couplings are used to safely transfer petroleum products, chemicals and various other liquids. During the first quarter of 2006, Gardner Denver completed an internal reorganization and these businesses are now part of the Company's Fluid Transfer Division. Accordingly, their financial results are included in the Fluid Transfer Products segment. The Todo Group, a manufacturer of self-sealing couplings acquired by Gardner Denver in January 2006, is also included in the Fluid Transfer Products segment. The 2005 reportable segment results included in this press release have been restated to conform to the current presentation. First Quarter Results Revenues increased $160.5 million (67%) to $399.3 million for the three months ended March 31, 2006, compared to the same period of 2005. Compressor and Vacuum Products segment revenues increased 68% for the three-month period of 2006, compared to the previous year, primarily due to the incremental effect of acquisitions, stronger demand, manufacturing and supply chain improvements that resulted in increased production output, and price increases. Fluid Transfer Products segment revenues increased 63% for the three months ended March 31, 2006, compared to the same period of 2005, due to stronger demand for drilling and well servicing pumps, manufacturing and supply chain improvements, incremental shipments as a result of increased outsourcing and price increases. (See Selected Financial Data Schedule.) Orders for the three-month period ended March 31, 2006 were $125.3 million (42%) higher than the same period of the previous year, due to acquisitions and organic growth. The year-over-year organic growth in orders for compressor and vacuum products was 9%. This segment represented approximately 80% of the Company's total revenues in the first three months of 2006. This organic order growth was relatively broad-based, with no specific market segment or region driving the improvement. The 7% organic order growth for fluid transfer products for the three-month period of 2006 resulted from a key customer placing two large orders for drilling pumps. Management was aware of the demand for these pumps, which are scheduled to ship in 2006, and was holding production capacity to satisfy these requirements. Despite the increased production levels in 2006, orders in each reportable segment exceeded revenues for the first quarter of 2006, resulting in a 5.8% total backlog increase from December 31, 2005. Gross margin (defined as revenues less cost of sales) as a percentage of revenues (gross margin percentage) increased to 35.1% in the three-month period ended March 31, 2006, from 32.6% in the same period of 2005. This improvement was attributable to cost reduction initiatives, leveraging fixed and semi-fixed costs over additional production volume, acquisitions and price increases. Favorable sales mix also contributed to increased gross margin as the first quarter of 2006 included a higher percentage of drilling pump and replacement pump parts sales than the previous year and these products generate gross margin percentages in excess of the Company's average. As a percentage of revenues, selling and administrative expenses decreased to 18.5% for the first three months of 2006, compared to 22.0% for the same period of 2005. Selling and administrative expenses increased $21.3 million in the three-month period ended March 31, 2006 to $73.7 million, due primarily to the incremental effect of acquisitions ($20.0 million) and stock-based compensation expense ($2.8 million), partially offset by changes in currency exchange rates and cost reductions. A disproportionate amount of stock-based compensation expense was recognized in the first quarter of 2006 due to the number of options and awards held by employees eligible for retirement. As a result of the improved gross margin percentage and leveraging selling and administrative expenses over higher revenues, operating margin for each reportable segment improved for the three-month period ended March 31, 2006, compared to the same period of 2005 and the three-month period ended December 31, 2005. Operating margin for the Compressor and Vacuum Products segment was 11.2% in the three months ended March 31, 2006, compared to 6.7% in the same period of 2005 and 10.5% for the three-month period ended December 31, 2005. The Fluid Transfer Products segment operating margin increased to 23.0% for the three months ended March 31, 2006, compared to 10.8% in the same period of 2005 and 21.0% for the three months ended December 31, 2005. Incremental borrowings necessary to complete acquisitions and higher effective interest rates resulted in increased interest expense for the three months ended March 31, 2006, compared to the same period of 2005. Furthermore, as a result of a more rapid repayment of debt, interest expense for the three-month period of 2006 included approximately $0.6 million of accelerated amortization of debt issuance costs. Including this accelerated amortization, the weighted average interest rate for the three-month period of 2006 was 6.9%, compared to 5.1% in the prior year period. Net income for the three months ended March 31, 2006 increased $20.2 million (196%) to $30.5 million, compared to $10.3 million in same period of 2005, despite the inclusion of stock-based compensation expense and a higher effective tax rate in 2006 (32%) than in 2005 (30%). These results include approximately $4.2 million of net income from Thomas Industries' operations for the three months ended March 31, 2006. The net income attributable to the acquisition of the Todo Group was not material during the first quarter of 2006. Diluted earnings per share for the first three months of 2006 was $1.15, 130% higher than the previous year as a result of the increased net income. The improvement in DEPS includes the dilutive effect of the issuance of 5.7 million shares in May 2005. Cash used in operating activities was approximately $8.8 million in the three-month period of 2006, compared to $12.1 million in the same period of 2005. Although the Company realized some benefit of lean manufacturing initiatives, investments in accounts receivable and inventory increased in the first quarter of 2006 as a result of rising revenues and greater material requirements associated with higher production levels. Opportunities for inventory reductions exist through the expanded use of lean manufacturing techniques and additional supplier performance improvements, and the Company expects to see improvements in inventory turnover during 2006. The Company invested approximately $6.5 million in capital expenditures in the three-month period of 2006, compared to $5.2 million in the same period of 2005. The higher spending in 2006 reflects incremental investments in acquisition integration, cost reductions and capital spending at Thomas Industries' operations. Capital spending is currently expected to be approximately $45 million to $50 million in 2006, and will be used primarily to integrate businesses, introduce new products and improve operations. Other than capital expenditures, cash provided by operations was used to repay debt. At the end of March 2006, debt to total capital was 45.3%, compared to 46.4% on December 31, 2005. Cautionary Statement Regarding Forward-Looking Statements All of the statements in this release, other than historical facts, are forward-looking statements made in reliance upon the safe harbor of the Private Securities Litigation Reform Act of 1995, including, without limitation, the statements made under the "CEO's Comments Regarding Results" and "Outlook" sections. As a general matter, forward-looking statements are those focused upon anticipated events or trends, expectations, and beliefs relating to matters that are not historical in nature. Such forward-looking statements are subject to uncertainties and factors relating to the Company's operations and business environment, all of which are difficult to predict and many of which are beyond the control of the Company. These uncertainties and factors could cause actual results to differ materially from those matters expressed in or implied by such forward-looking statements. The following uncertainties and factors, among others, could affect future performance and cause actual results to differ materially from those expressed in or implied by forward-looking statements: (1) the ability to effectively integrate acquisitions, including product and manufacturing rationalization initiatives, and realize anticipated cost savings, synergies and revenue enhancements; (2) the risk that the Company may incur significant cash integration costs to achieve any such cost savings; (3) the Company's exposure to economic downturns and market cycles, particularly the level of oil and natural gas prices and oil and gas drilling and production, which affect demand for the Company's petroleum products, and industrial production and manufacturing capacity utilization rates, which affect demand for the Company's compressor and vacuum products; (4) the risks of large or rapid increases in raw material costs or substantial decreases in their availability, and the Company's dependence on particular suppliers, particularly iron casting and other metal suppliers; (5) the risks associated with intense competition in the Company's markets, particularly the pricing of the Company's products; (6) the Company's ability to continue to identify and complete other strategic acquisitions and effectively integrate such acquisitions to achieve desired financial benefits; (7) the risks associated with the reduced liquidity generated by the substantial additional indebtedness incurred to complete the Thomas Industries acquisition, including reduced liquidity for working capital and other purposes, increased vulnerability to general economic conditions and floating interest rates, and reduced financial and operating flexibility due to increased covenant and other restrictions in the Company's credit facilities and indentures; (8) economic, political and other risks associated with the Company's international sales and operations, including changes in currency exchange rates (primarily between the U.S. dollar, the Euro, the British pound and the Chinese yuan); (9) the risks associated with pending asbestos and silicosis personal injury lawsuits, as well as other potential product liability and warranty claims due to the nature of the Company's products; (10) the risks associated with environmental compliance costs and liabilities; (11) the ability to attract and retain quality management personnel; (12) the ability to avoid employee work stoppages and other labor difficulties; (13) the risks associated with defending against potential intellectual property claims and enforcing intellectual property rights; (14) market performance of pension plan assets and changes in discount rates used for actuarial assumptions in pension and other postretirement obligation and expense calculations; (15) the risk of possible future charges if the Company determines that the value of goodwill or other intangible assets has been impaired; and (16) changes in laws and regulations, including accounting standards, tax requirements and related interpretations or guidance. The Company does not undertake, and hereby disclaims, any duty to update these forward-looking statements, although its situation and circumstances may change in the future. Comparisons of the financial results for the three-month periods ended March 31, 2006 and 2005 follow. Gardner Denver will broadcast a conference call to discuss first quarter earnings on Thursday, April 27, 2006 at 9:30 a.m. Eastern time, through a live webcast. This free webcast will be available in listen-only mode and can be accessed, for up to ninety days following the call, through the Investor Relations page on the Gardner Denver website ( http://www.gardnerdenver.com ) or through Thomson StreetEvents at http://www.earnings.com . Gardner Denver, Inc., with 2005 revenues of $1.2 billion ($1.4 billion on a pro forma basis including the acquisition of Thomas Industries, which was completed in July 2005) is a leading worldwide manufacturer of reciprocating, rotary and vane compressors, liquid ring pumps and blowers for various industrial and transportation applications, pumps used in the petroleum and industrial markets, and other fluid transfer equipment serving chemical, petroleum, and food industries. Gardner Denver's news releases are available by visiting the Investor Relations page on the Company's website ( http://www.gardnerdenver.com ). GARDNER DENVER, INC. CONSOLIDATED STATEMENTS OF OPERATIONS GARDNER DENVER, INC. CONDENSED BALANCE SHEET ITEMS GARDNER DENVER, INC. BUSINESS SEGMENT RESULTS GARDNER DENVER, INC. SELECTED FINANCIAL DATA SCHEDULE GARDNER DENVER, INC. SELECTED FINANCIAL DATA SCHEDULE New API 681 Liquid Ring Vacuum Pump Series for Chemistry and Petrochemistry LEDERLE GmbH will present its new liquid ring vacuum pump series LVP on the ACHEMA 2006. These pumps especially are fitted to the demands of chemistry and petrochemistry. The construction considers the requirements according to API 681. Special features are: - increased compression strength PN 10 test pressure 15 bar in standard execution - flexible material selection - high casing tightness - all sizes also hermetically sealed with magnetic coupling or canned motor. The range covers 10 sizes with a suction capacity of 50 m³/h to 1800 m³/h. All pumps are executed according to standard in stainless steel 1.4581, further materials from cast steel to titanium are available. www.hermetic-pumpen.com Angstrom Sciences Appoints MidWestern Representative Pittsburgh, PA, January 17, 2006 - Angstrom Sciences announces the expansion of its sales representation network by appointing a new sales representative to the Midwestern US: • Alan Burrill of ALAN BURRILL TECHNICAL SALES was hired to cover the states of Illinois and Missouri. Alan can be contacted by telephone at 414-327-9055, or by e-mail at awburrill@earthlink.net. • John Blaze Sr., John Blaze Jr., Jerry Blaze, George Soares and Pat McFeeley of EASTERN SCIENTIFIC, for Massachusetts, Connecticut, Rhode Island, Maine, New Hampshire, Vermont, Maryland, Delaware, District of Columbia, Virginia, North Carolina and South Carolina. • Douglas Becker of FIL-TECH WEST, for Northern California. • Rick Nissen, Shane Sullivan and Ken Szefi of NORTHEAST VACUUM SUPPLY COMPANY, for Pennsylvania, West Virginia, Ohio, Indiana and Michigan. • Terry Reilly, Terry Spooner, Mike Frank, Tom Leeland, Maury McKenna and David Opoien of SEMITORR, INC., for Oregon, Washington, Idaho and Southern California. • Greg Vaughan and Thomas Parker of SCHOONOVER, INC. for Florida, Georgia, Alabama, Mississippi & Tennessee. • Rob Armstrong and Mike Whiteside of TELESIS HIGH VACUUM, for Texas, Louisiana, Oklahoma and Arkansas. • Steve Borden of TORVAC, for Minnesota, Wisconsin, Iowa, North Dakota, South Dakota. • Glenn Buttermore and Scott Godfrey of TRI-STATE TECHNOLOGY, for Eastern Pennsylvania, New Jersey and New York. Angstrom Sciences is the world leader in magnetron technology used to produce thin films by the “sputtering” process. Sputtering is used to manufacture advanced products such as microelectronics, storage media, energy efficient architectural glass and fiber optic network components. The company holds patents in the use of shaped magnets and turbulent cooling water flow in magnetron designs. Angstrom magnetrons provide the unique combination of high target utilization and deposition rates with uncompromised film quality - known collectively as the “Angstrom AdvantageÔ.” The company has a worldwide business presence and is headquartered in Pittsburgh, PA. For further Information, please contact Angstrom Sciences - www.angstromsciences.com Tel. +1 412-469-8466email: info@angstromsciences.com Angstrom Sciences Hires Production Planner to Implement New ERP System Pittsburgh, PA, January 17, 2006 Angstrom Sciences announces the appointment of Mark Bates to the position of Production Planner. Bates’ immediate responsibilities are to optimize the scheduling of jobs in engineering and manufacturing through the implementation of a new ERP system. This system was put in place to develop internal protocols and make production flow more efficient. Mark Bates has over 10 years of experience in the design-to-build manufacturing industry with a background in project and materials management. “Mark’s experience will greatly help us to implement our ERP System, which will in turn facilitate the delivery of our products in a more timely and predictable manner.” said Mark A. Bernick, President of Angstrom Sciences. Angstrom Sciences is the world leader in magnetron technology used to produce thin films by the “sputtering” process. Sputtering is used to manufacture advanced products such as microelectronics, storage media, energy efficient architectural glass and fiber optic network components. The company holds patents in the use of shaped magnets and turbulent cooling water flow in magnetron designs. Angstrom magnetrons provide the unique combination of high target utilization and deposition rates with uncompromised film quality - known collectively as the “Angstrom AdvantageÔ.” The company has a worldwide business presence and is headquartered in Pittsburgh, PA. For further Information, please contact Angstrom Sciences - www.angstromsciences.com Tel. +1 412-469-8466email: info@angstromsciences.com |

vacuum-guide.com

Are you lauching a new product ? Did your company built a new plant ? delivered an important piece of equipment? agreed to a distribution agreement ? ... Publish your article, post your news release, email now to: info@vacuum-guide.com  mehr Nachrichten

mehr Nachrichten l'actualité du vide

l'actualité du vide |